AI’s Role in Compliance Monitoring

Staying compliant with regulatory standards is an ongoing challenge for businesses across industries. AI transforms compliance management by offering real-time monitoring, automated enforcement, and predictive analytics to help organizations identify and prevent violations before they escalate.

Unlike manual methods that rely on periodic audits, AI-driven compliance tools continuously track transactions, communications, and internal processes to flag potential breaches. With the ability to adapt to regulatory changes and evolving fraud tactics, AI is reshaping how businesses maintain compliance with minimal human intervention.

AI-Powered Fraud Detection

Fraud remains a persistent issue in regulatory compliance. AI fraud detection systems analyze vast amounts of data to identify irregular patterns that signal potential fraud or non-compliance. These systems detect suspicious transactions, unauthorized access attempts, and inconsistencies in reporting, helping businesses act before violations occur.

For instance, financial institutions rely on AI to monitor real-time transactions, detecting anomalies linked to money laundering or fraudulent activities. By learning from past incidents, AI models refine their detection accuracy, reducing false positives and strengthening fraud prevention efforts.

Automating Regulatory Compliance

Keeping up with changing regulations requires constant adjustments to internal policies. AI simplifies compliance by automating the tracking of regulatory updates, applying necessary policy modifications, and ensuring organizations stay aligned with industry standards.

AI transforms compliance automation by scanning legal frameworks, interpreting new compliance requirements, and integrating updates into company workflows. This eliminates manual oversight errors and reduces the risk of regulatory penalties. Businesses operating under strict compliance frameworks—such as GDPR, AML, and HIPAA—benefit from AI’s consistent adherence to evolving standards.

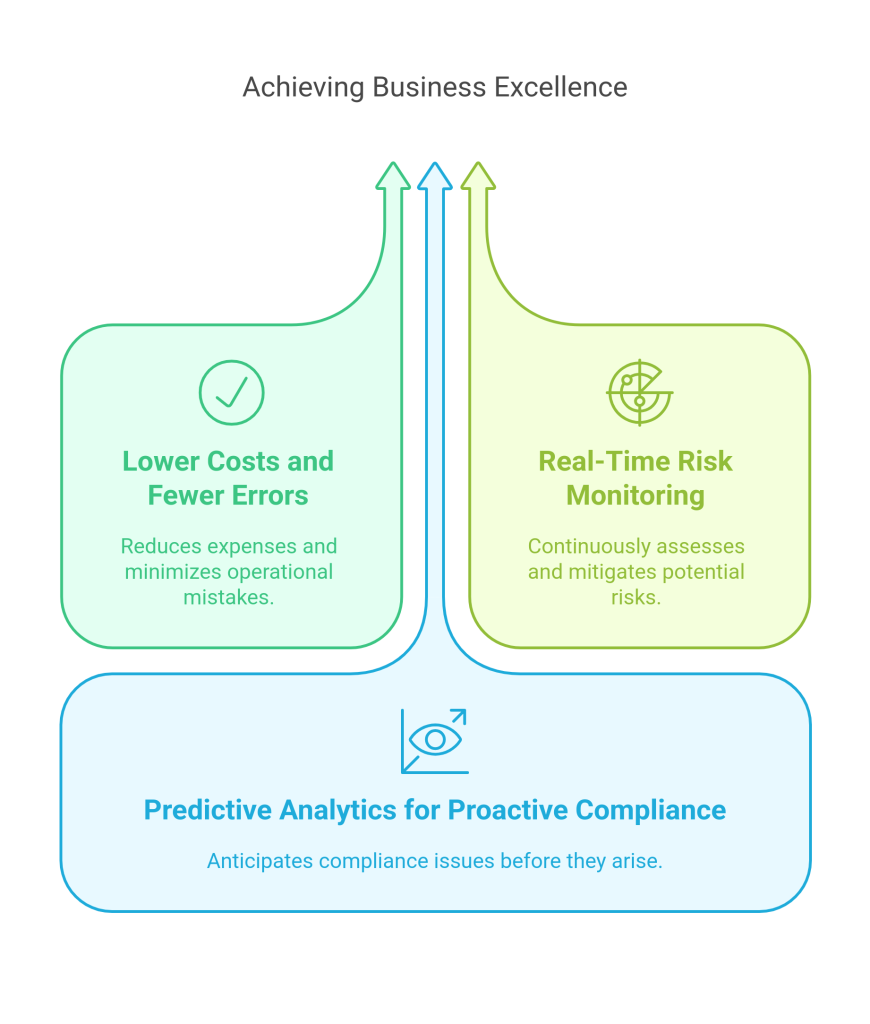

Key Benefits of AI in Compliance

1. Lower Costs and Fewer Errors

Traditional compliance management demands extensive human resources. AI reduces costs by automating routine processes such as audit reporting, transaction monitoring, and document verification, freeing compliance teams to focus on strategic decision-making.

2. Real-Time Risk Monitoring

Unlike periodic compliance assessments, AI systems continuously scan for risks, ensuring businesses detect and address compliance issues as they arise. This real-time approach prevents financial losses, reputational damage, and regulatory action.

3. Predictive Analytics for Proactive Compliance

By analyzing historical data and behavioral trends, AI can identify compliance risks before they lead to violations. Predictive fraud prevention tools flag high-risk activities, allowing businesses to take corrective action before regulatory breaches occur.

For example, AI-driven tools in the financial sector detect early warning signs of fraudulent transactions before they trigger compliance failures. This proactive approach strengthens security compliance and minimizes exposure to regulatory fines.

Challenges in AI Compliance Implementation

Despite its advantages, integrating AI into compliance management presents challenges that businesses must navigate:

- Data Privacy & Security: AI systems handle sensitive data, making robust encryption and strict access controls essential.

- Bias & Transparency: AI models must operate transparently to ensure fair and unbiased compliance decisions.

- Legacy System Integration: Many businesses rely on outdated compliance infrastructures. AI-powered APIs and middleware solutions help modernize legacy systems without disrupting operations.

Future of AI in Compliance

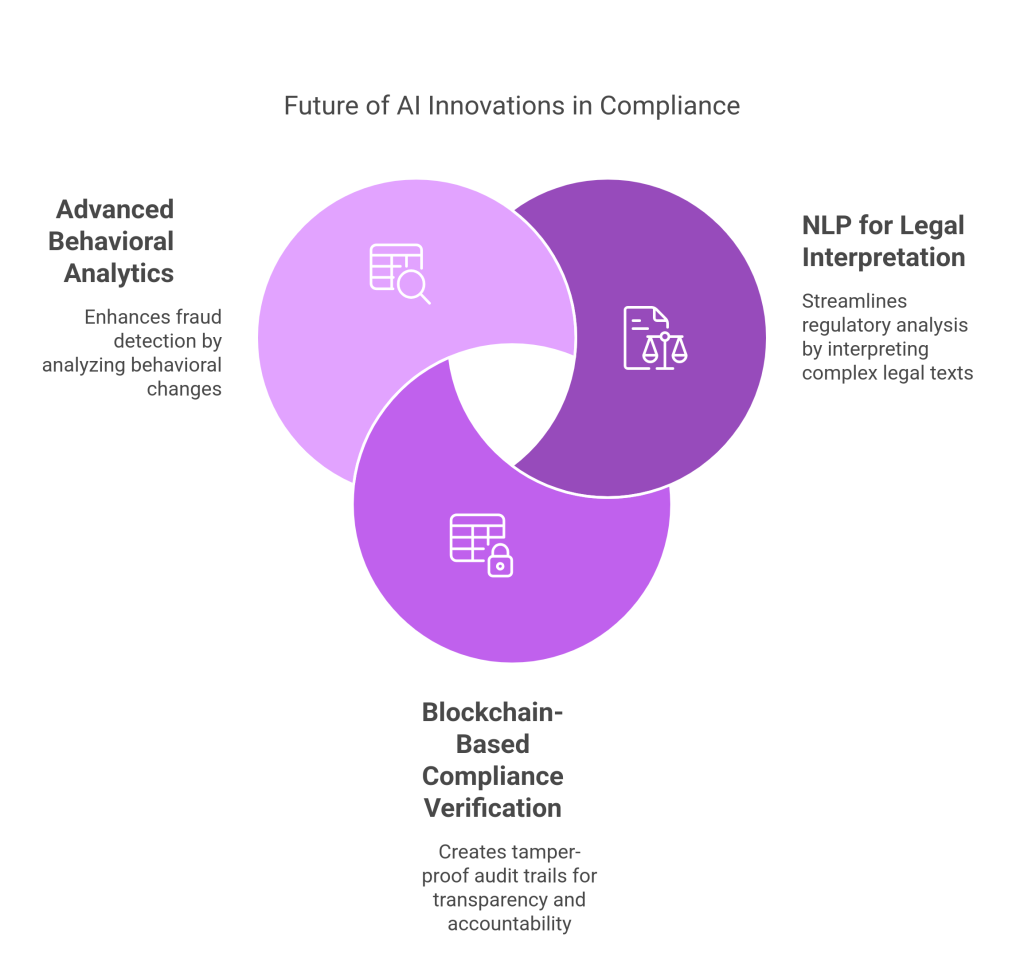

The next generation of AI compliance tools will offer even greater accuracy and automation. Key developments include:

- Natural Language Processing (NLP) for Legal Interpretation: AI will streamline regulatory analysis by interpreting complex legal texts and aligning internal policies with new laws.

- Blockchain-Based Compliance Verification: AI and blockchain will create tamper-proof audit trails, enhancing transparency and accountability in compliance management.

- Advanced Behavioral Analytics for Fraud Detection: AI models will improve their ability to detect subtle changes in employee or financial behavior, refining compliance risk assessments.

Organizations that adopt AI-driven compliance strategies will gain a competitive edge and reduce the risk of regulatory penalties and operational disruptions.

Conclusion

AI is reshaping compliance management, making it more efficient, accurate, and proactive. Businesses can stay ahead of regulatory changes and mitigate compliance risks by leveraging AI-driven fraud detection, predictive analytics, and automated compliance enforcement.

With increasing regulatory scrutiny, companies that fail to integrate AI into their compliance frameworks risk falling behind. Investing in AI-powered compliance solutions ensures long-term regulatory adherence, protecting businesses from legal, financial, and reputational harm.