Discover how AI is transforming regulatory change management. Learn strategies to stay compliant, reduce risk, and adapt faster in a constantly shifting landscape

Organizations constantly struggle to remain abreast of modifications to regulations in the rapidly changing worldwide legislative environment of today without compromising effectiveness or safety. Particularly for businesses that operate in several countries, regulatory change management, or RCM, has emerged as a crucial function. AI compliance tools are rapidly becoming the preferred option for swiftly, accurately, and confidently handling this amount of detail.

This blog explores the role of AI in regulatory change management, the challenges businesses face, and how automation can help organizations future proof their compliance programs.

What Is Regulatory Change Management?

The organized method of locating, evaluating, and putting into effect changes to laws, rules, or guidelines that have an impact on the way a company operates is known as regulatory change administration. Installing an anticipatory framework that helps minimize risks and uphold conformance generally is more important than only responding to new rules.

Why It Matters Now More Than Ever

- Regulations are increasing in volume and complexity globally

- Non compliance can result in hefty fines, reputational damage, and operational disruptions

- Traditional manual methods of tracking regulatory changes are slow and error prone

The Challenges of Manual Compliance Tracking

Despite the stakes, many companies still rely on spreadsheets, emails, and fragmented tools to monitor regulatory change. Here’s why that’s a problem:

1. Delayed Updates

Relying on manual tracking often means businesses react after a regulation is in force. This lag can leave gaps in compliance, increasing legal and financial risk.

2. Siloed Information

Without centralized platforms, regulatory updates may not reach the right teams or departments, leading to inconsistent interpretations and implementation.

3. Human Error

Manual processes are vulnerable to oversight, especially when dealing with high volumes of updates across jurisdictions.

The AI Advantage in Regulatory Change Management

AI in regulatory change management tools like Sahl bring automation, intelligence, and speed to the entire regulatory change process. Here’s how:

Monitoring With AI in Regulatory Change Management

AI systems continuously scan regulatory databases, government websites, and industry sources to flag changes instantly well before traditional methods detect them.

Automated Impact Assessment

Sah’s AI can match regulatory updates to specific policies, procedures, or business units, helping teams understand what needs to change and why.

Intelligent Workflow Integration

From assigning action items to the right stakeholders to setting automated reminders and deadlines, AI compliance systems streamline every step of regulatory change execution.

Benefits of AI Powered Regulatory Change Management

Let’s break down the key benefits that AI in regulatory change management offers:

Proactive Compliance

With real time alerts and predictive analytics, organizations can prepare for upcoming changes before they take effect, staying ahead of the curve.

Reduced Operational Risk

AI removes the uncertainty and inconsistency of human based processes, significantly lowering the risk of compliance violations.

Improved Resource Allocation

Free your compliance teams from time consuming manual tracking and let them focus on higher value tasks like policy improvement or risk strategy. Feel free to try our AI in action.

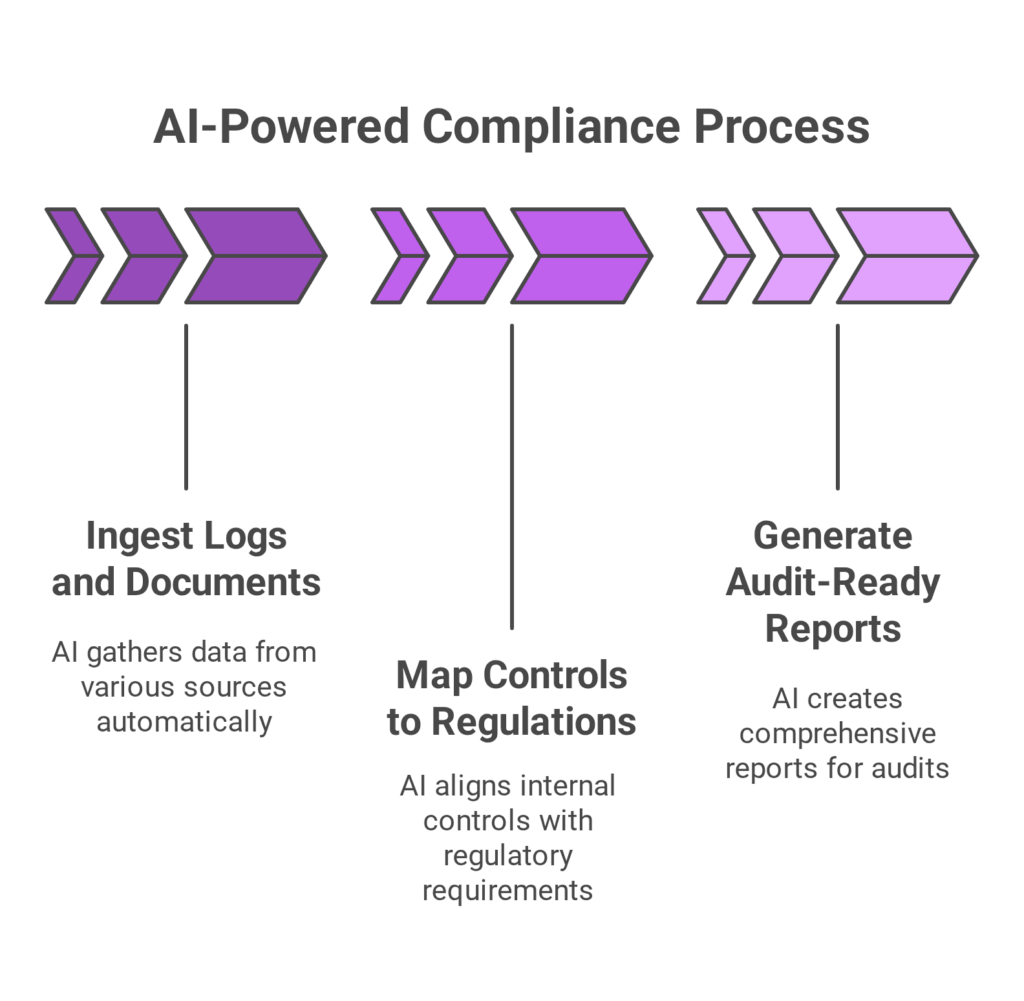

Enhanced Audit Readiness

AI platforms maintain detailed logs of all compliance activities, which are invaluable during audits or regulatory inspections.

Industries Where AI Compliance Transforms RCM

AI in regulatory change management isn’t just for banks or multinationals it’s a game changer across sectors:

Financial Services

With evolving AML, KYC, and PSD2 requirements, banks and fintechs need a dynamic system to stay compliant globally.

Healthcare

AI ensures compliance with data protection laws like HIPAA, PDPL, and GDPR especially critical when patient data is involved.

SaaS and Tech

Cloud native companies operating across borders must manage cybersecurity frameworks like ISO 27001, SOC 2, and more.

Manufacturing & Supply Chain

Environmental, labor, and product safety regulations require constant monitoring across regions an ideal use case for AI compliance platforms.

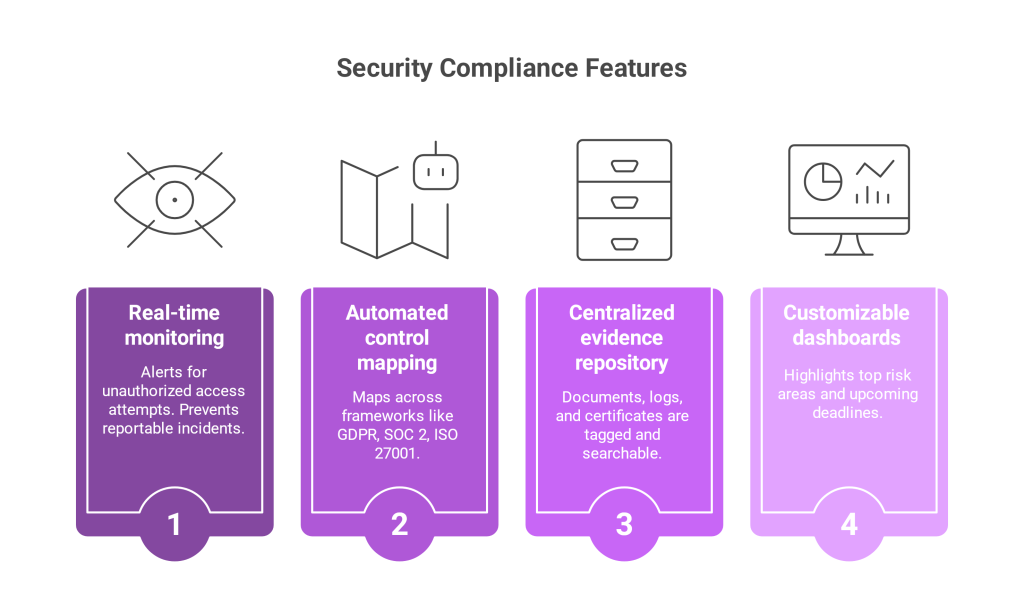

Key Features to Look for in an AI Compliance Tool

When evaluating an AI solution for AI in regulatory change management, consider the following must haves:

Multijurisdictional Coverage

The platform should cover global regulations relevant to your business and provide local language support when needed.

Smart Impact Analysis

It must identify affected policies, controls, or departments based on rule changes automatically.

Customizable Dashboards

Role based views that surface the right insights to compliance managers, legal teams, and Collaboration Workflows

Ability to assign tasks, track status, and integrate with Slack, Jira, or other internal tools.

Audit Trails

Every action taken on the platform should be logged for transparency and future audits.

How Sahl Simplifies Regulatory Change with AI Compliance

Sahl offers a powerful AI in regulatory change management engine tailored to organizations looking to modernize their governance frameworks. Its platform is designed to help businesses:

- Monitor regulatory changes in real time across MENA, the EU, and beyond

- Map those changes to existing policies, frameworks, and stakeholders

- Orchestrate cross functional action plans with automated workflows

- Document and demonstrate compliance with full audit support

Sahl’s intuitive dashboard makes it easy to manage multiple frameworks like ISO 27001, GDPR, PDPL, and SOC 2 without the chaos of spreadsheets or siloed email chains.

Best Practices for Implementing AI in Regulatory Change Management

Before adopting an AI compliance solution, here’s how to ensure success:

Establish Clear Ownership

Assign a regulatory change leader or team responsible for overseeing the process end to end.

Centralize Policies

Store all policies and documentation in one place, so AI can effectively map and assess impacts.

Regularly Review AI Recommendations

While AI is powerful, periodic human review ensures the insights align with your unique risk appetite.

Start Small, Then Scale

Begin with one regulation or framework, prove value, then expand platform usage across departments and jurisdictions.

The Future of Regulatory Change Management

AI in regulatory change management is becoming more intricate with the rise of cross border data laws, evolving cyber threats, and shifting compliance mandates. In this complex landscape, the future of regulatory change management lies in automation, intelligence, and agility. AI is no longer a futuristic concept, it is the driving force reshaping compliance strategies.

AI enables companies to transition from manual, error prone monitoring to a continuous, dynamic model of compliance. The ability to auto detect policy updates, interpret legal language, and map risks across jurisdictions means organizations can anticipate change rather than merely react to it.

Tools like Sahl, which integrate artificial intelligence (AI) in regulatory change management, using natural language processing and statistical analysis to provide immediate feedback and practical recommendations, will become increasingly important in the future of regulatory change control. Compliant teams can turn into collaborators in administration and managing risks with the aid of these solutions, which also lessen operational load.

In short, the future belongs to businesses that leverage intelligent compliance infrastructure where AI empowers human experts to focus on decision making, policy development, and enterprise resilience.

Conclusion: AI in Regulatory Change Management is The Future

As global regulatory landscapes continue to evolve, businesses must shift from reactive compliance strategies to proactive, intelligent approaches. Traditional tools and manual monitoring can no longer keep up with the complexity, volume, and velocity of today’s regulatory changes. AI and machine learning offer a transformative path forward enhancing accuracy, reducing risk, and unlocking operational efficiency.

Platforms like Sahl empower compliance teams with automated tracking, real time alerts, and contextual analysis, enabling organizations to stay ahead of changes rather than scrambling to catch up. By integrating AI into your compliance stack, you’re not just managing risk you’re building a future proof compliance culture that scales with your growth, adapts to global regulations, and delivers confidence to stakeholders.

Now is the time to embrace the power of AI not as a buzzword, but as a strategic compliance enabler that reshapes how organizations approach governance in a digital first world.

Frequently Asked Questions (FAQs)

Q) What is regulatory change management in compliance?

Regulatory change management (RCM) is the process of identifying, assessing, and implementing changes to laws and standards that affect a business’s operations.

Q) How does AI help with regulatory change management?

AI helps by automatically monitoring regulation updates, assessing their impact, and assigning tasks for implementation all faster and more accurately than manual methods.

Q) Is AI compliance suitable for small businesses?

Yes. Many AI compliance tools are scalable, offering features that can be tailored to smaller organizations with fewer regulations to track.

Q) Can AI compliance platforms work across multiple jurisdictions?

Yes. Advanced platforms like Sahl support global regulations and can provide localized insights for better compliance.

Q) How does AI reduce compliance risk?

AI minimizes human error, ensures timely updates, and maintains a detailed audit trail all of which significantly reduce compliance risk.

Q) How often do AI compliance tools update regulatory content?

Most AI compliance platforms update in real time or on a daily basis, depending on the sources monitored. This ensures your organization is always working with the most current legal and regulatory information.

Q) Can AI compliance solutions integrate with our existing tools?

Yes. Leading platforms like Sahl offer API integrations and plug ins that work with internal systems like GRC platforms, document repositories, Slack, Jira, and more, enabling seamless workflow automation.

Q) How secure is data within an AI compliance platform?

Top AI platforms follow strict data security standards such as ISO 27001, SOC 2, and GDPR compliance, with encryption, access control, and audit trails built into the system.