ISO 27001 compliance has become a strategic necessity for security-conscious businesses operating in digital environments. It is no longer a framework reserved for large enterprises or government contractors. Today, even mid-sized SaaS providers, healthtech platforms, and financial service companies are being asked to demonstrate robust security controls through ISO 27001 certification. Without it, partnerships slow down, enterprise clients hesitate, and operational risks remain unquantified.

But while the business case is clear, the path to ISO 27001 certification often feels complex. It involves detailed policies, documentation, internal reviews, and a sustained focus on information security management. For companies scaling quickly or managing multiple systems across geographies, staying audit-ready can feel like an ongoing challenge.

What ISO 27001 Compliance Involves

ISO 27001 is an internationally recognized standard for managing information security risks. It provides a formal set of specifications for implementing, maintaining, and continually improving an Information Security Management System (ISMS). The goal is not just to pass an audit but to build a repeatable, resilient system of security governance.

Core requirements include:

- Documented policies covering access controls, risk assessments, and incident response

- A defined risk management methodology

- Internal audits and management reviews at regular intervals

- A continual improvement plan backed by leadership commitment

Organizations must show not only that they have controls in place, but that those controls are consistently applied, monitored, and improved. The burden of proof is high, and traditional manual methods often fall short.

Where Traditional Approaches Fall Short

For many businesses, ISO 27001 compliance becomes a patchwork of disconnected spreadsheets, policies written in Word documents, and last-minute audit prep. Even teams with strong technical capabilities struggle to maintain alignment across departments.

Common challenges include:

- Manual processes that are hard to scale

- Inconsistent evidence gathering

- Limited visibility into control effectiveness

- Lack of real-time monitoring or risk tracking

This results in delayed certification timelines, audit stress, and internal inefficiencies that drain resources.

How AI Is Reshaping ISO 27001 Certification

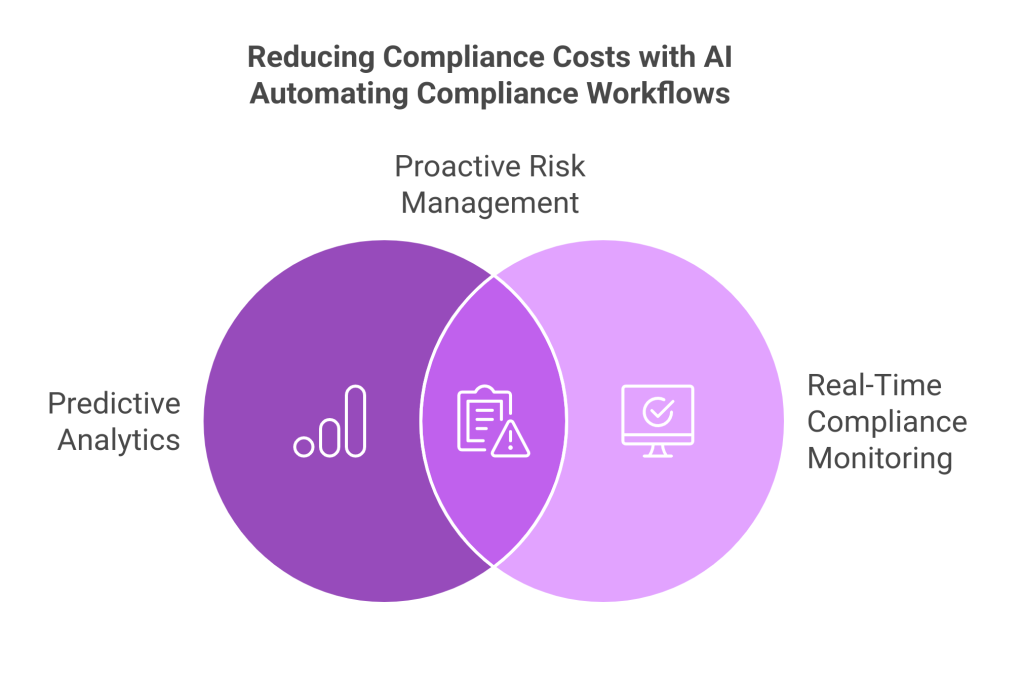

AI-powered compliance automation platforms like Sahl are transforming how teams approach ISO 27001. Rather than reacting to audits, organizations can adopt a proactive, real-time compliance posture.

With an automated platform, businesses can:

- Map operational activities directly to ISO 27001 clauses

- Automate evidence collection for faster audits

- Track control performance through live dashboards

- Schedule internal audits and flag control drift

- Maintain documentation and version history in one secure place

This shift reduces the need for heavy manual oversight and allows compliance leaders to focus on governance and strategic risk reduction.

Real-World Benefits of ISO 27001 Automation

Automating ISO 27001 compliance delivers more than just time savings. It helps teams build a more credible, defensible, and agile compliance posture.

Key benefits include:

- Greater stakeholder trust through consistent documentation

- Shorter audit cycles with always-ready reporting

- Fewer manual errors and missed steps

- Improved alignment between operations, risk, and security teams

These improvements are especially valuable for organizations in regulated industries like fintech, HIPAA compliance services, and infrastructure.

Choosing the Right ISO 27001 Compliance Software

Not all compliance platforms are built with ISO 27001 in mind. Look for one that:

- Includes native control mapping to Annex A requirements

- Offers real-time risk scoring and audit logs

- Supports secure evidence storage and version control

- Integrates with cloud infrastructure and ticketing tools

A purpose-built platform should feel less like another tool to manage and more like a compliance partner your teams can rely on.

Final Thought

Achieving ISO 27001 certification no longer needs to feel like an overwhelming project. With the right automation tools, growing businesses can reduce complexity, shorten certification timelines, and build lasting trust with partners and regulators. As compliance expectations increase, forward-thinking teams are choosing AI-powered platforms to stay prepared, confident, and aligned.

If your organization is preparing for ISO 27001 or seeking to streamline existing security frameworks, Sahl’s compliance automation platform offers a practical, scalable way forward.