Data privacy has recently moved to the forefront of regulatory concerns worldwide. As the digital landscape rapidly expands in Saudi Arabia, the need to safeguard personal data has never been greater. The introduction of the Personal Data Protection Law (PDPL) represents a pivotal step toward protecting individuals’ data rights and promoting responsible data handling across all sectors.

For businesses operating in the Kingdom, compliance with PDPL is not merely a legal obligation—it is a foundational element of maintaining customer trust and regulatory integrity. Whether you’re a local company, an international entity, or a tech startup, understanding and implementing PDPL compliance is now essential.

Table of Contents

- What is PDPL and Why Does It Matter?

- Understanding Saudi Arabia’s Personal Data Protection Law (PDPL)

- Key Provisions of Saudi Arabia’s PDPL

- Compliance Obligations for Organizations under PDPL

- Penalties and Consequences of Non-Compliance with PDPL

- Best Practices for PDPL Compliance

- Addressing Cross-Border Data Transfers Under PDPL

- Data Subject Rights Under PDPL

- Implementing a PDPL Compliance Strategy

- Tools and Technologies to Support PDPL Compliance

- Case Studies and Real-World Examples (To be covered – you can add these or remove this section)

- How Sahl Simplifies PDPL Compliance

- FAQs about PDPL Compliance

- Conclusion

What is PDPL and Why Does It Matter?

The Saudi Personal Data Protection Law (PDPL), issued by the Saudi Data and Artificial Intelligence Authority (SDAIA), defines clear standards for how personal data is collected, processed, and stored. SDAIA also serves as the regulatory authority responsible for enforcing PDPL compliance.

In today’s data-driven world, where breaches are common, PDPL provides a structured framework to ensure responsible data handling. Ultimately, it enhances data security while safeguarding individual privacy.

Why PDPL Matters to Businesses

Compliance with PDPL is essential for any organization managing personal data. Beyond avoiding penalties, it reinforces business credibility and builds customer trust. In contrast, failure to comply could lead to hefty fines and lasting reputational harm—outcomes no organization can afford to ignore.

Key Objectives of PDPL

The law aims to safeguard personal data by ensuring that organizations handle it responsibly and transparently. This transparency and accountability are key to building trust with individuals whose data is being handled. The law includes establishing clear guidelines for collecting, processing, and transferring data. Organizations are held accountable for data misuse and are expected to maintain transparency in their data handling practices.

Core Requirements of Saudi Arabia’s PDPL

Achieving PDPL compliance involves understanding its key requirements and implementing structured practices accordingly.

First, organizations must have a clear purpose when collecting personal data. Individuals should be fully informed about why their data is being collected and must give explicit consent before processing begins. Moreover, the processing itself should always align with the originally stated purpose.

Furthermore, individuals have specific rights regarding their data. They can access, correct, or request the deletion of their personal information. To comply, organizations must make data processing activities transparent and accessible and ensure that consent is clear, informed, and well-documented.

Data transfer outside Saudi Arabia is another critical aspect. Such transfers require explicit consent, and businesses must ensure that the data remains secure across borders. Organizations should be prepared to demonstrate the adequacy of the receiving country’s data protection measures.

In the unfortunate event of a data breach, organizations must report it to the SDAIA within a set timeframe. If the breach compromises the security of personal data, the affected individuals must also be informed promptly.

PDPL Compared to Global Data Protection Laws (like GDPR)

Although PDPL shares some similarities with global frameworks such as the General Data Protection Regulation (GDPR), it also has distinct regional characteristics. While GDPR applies to the data of EU citizens worldwide, PDPL focuses explicitly on data within Saudi Arabia. Consent requirements are also more explicit under PDPL, particularly concerning cross-border data transfers, which are more restricted than GDPR’s relatively free transfer policies within the EU.

Understanding these differences is crucial for organizations operating in multiple jurisdictions. It helps navigate compliance efficiently, ensuring that practices are consistent yet tailored to meet the specific demands of both regulations.

Understanding Saudi Arabia’s Personal Data Protection Law (PDPL)

The Personal Data Protection Law (PDPL) of Saudi Arabia marks a pivotal development in regulating how personal data is managed within the Kingdom. Introduced in 2021 and overseen by the Saudi Data and Artificial Intelligence Authority (SDAIA), a regulatory body responsible for overseeing data protection and artificial intelligence matters, PDPL seeks to enhance data privacy while fostering transparency and accountability among organizations that handle personal information.

The law is a set of rules and a framework designed to balance data security with individual privacy rights. As businesses increasingly collect and store personal information, adhering to PDPL has become a priority to mitigate legal risks and maintain public trust.

Key Objectives of PDPL

At its core, PDPL aims to protect personal data and regulate how it is collected, processed, and stored. The primary goals include safeguarding data from misuse, granting individuals greater control over their information, and promoting transparent data practices among organizations. This alignment with global standards, including GDPR, ensures consistent and robust data protection practices.

One of the most significant aspects of PDPL is its comprehensive reach. The law applies to all organizations operating within Saudi Arabia, regardless of size or sector. Furthermore, international companies handling data related to Saudi residents must also adhere to PDPL regulations. This broad applicability ensures that data protection practices are consistent and robust, even when data crosses borders, making everyone a part of the data protection ecosystem.

Key Definitions Under PDPL

To fully understand PDPL, it is essential to recognize some fundamental terms:

- Personal Data: is information that directly or indirectly identifies an individual, such as names, contact details, or biometric data.

- Data Controller: An entity that determines the purpose and means of data processing.

- Data Processor: An entity that processes data on behalf of the data controller.

- Sensitive Personal Data: Information related to race, religion, health, or financial status requiring additional protection measures.

Why Compliance Matters

Compliance with PDPL is not just a legal obligation it is a strategic priority for businesses aiming to build credibility and maintain consumer trust. Failure to adhere to the law can lead to severe penalties, including fines of up to [specific amount] and legal action, but the consequences go beyond financial loss. Non-compliance can damage a company’s reputation, leading to a loss of customer confidence.

By integrating PDPL requirements into daily operations, businesses can demonstrate a proactive commitment to data privacy. This approach helps avoid regulatory issues and reassures customers and partners that the company is a trusted guardian of their data in the digital landscape.

For more detailed insights on compliance strategies, visit Sahl’s Compliance Hub, which offers resources tailored to your business needs.

Key Provisions of Saudi Arabia’s PDPL

The Saudi Personal Data Protection Law (PDPL) is a comprehensive set of provisions regulating personal data collection, storage, processing, and sharing. These provisions are not just about protecting individual rights but also about defining the responsibilities of organizations managing personal data. It’s crucial to understand and implement these key requirements, as it’s the cornerstone for maintaining compliance and building trust with data.

Data Collection and Processing

Organizations must ensure that personal data is collected and processed lawfully and transparently. Data should only be gathered with explicit consent or when required for legal or contractual obligations. Additionally, data collection should be purpose-driven, meaning only the data necessary for the stated purpose should be obtained. To maintain data integrity, organizations must also regularly update and verify the accuracy of their collected information.

Data Subject Rights

PDPL empowers individuals with several necessary rights regarding their data. These include the right to access their information, request corrections, and even demand deletion when justified. Individuals also have the right to object to data processing that infringes on their rights or privacy. Data portability allows individuals to obtain and reuse their data across different services. Respecting and upholding these rights is not just a legal obligation but a way to empower individuals and build trust.

Data Security Measures

One of the key requirements of the PDPL is the implementation of robust security protocols to safeguard personal data. This includes encrypting sensitive data and anonymizing it where feasible. Access to data should be strictly controlled, with measures in place to detect and respond to breaches promptly. An effective incident response plan ensures that affected individuals and authorities are notified immediately, minimizing potential harm.

Cross-Border Data Transfers

Transferring personal data outside of Saudi Arabia necessitates additional precautions. Organizations must ensure that the recipient country upholds a comparable level of data protection. Explicit consent from data subjects is essential; in some cases, government authorization may be required to proceed with the transfer. Documenting these processes helps maintain compliance and transparency.

Data Breach Notification

In the unfortunate event of a data breach, organizations must act swiftly. Reporting the incident to the Saudi Data and Artificial Intelligence Authority (SDAIA) within 72 hours is mandatory. If the breach poses a significant risk to individuals, they must also be informed promptly. Taking immediate steps to contain the breach and mitigate potential damage is essential.

Data Retention and Disposal

Data should not be kept longer than necessary. Organizations must establish clear data retention policies and securely delete or anonymize information that is no longer required. Maintaining records of data disposal activities helps demonstrate compliance with PDPL.

Accountability and Governance

Accountability and governance play a crucial role in data protection. Organizations should designate a data protection officer (DPO) to foster a culture of compliance, particularly when processing large volumes of sensitive data. Conducting Data Protection Impact Assessments (DPIAs) helps identify potential risks, and ongoing staff training ensures that employees understand their data protection responsibilities. Maintaining comprehensive records of processing activities further strengthens governance.

Consequences of Non-Compliance

Non-compliance with PDPL can lead to significant penalties, including hefty fines and operational restrictions. Beyond financial repercussions, businesses may suffer reputational damage, impacting customer trust and stakeholder confidence.

Implementing and adhering to these key provisions is crucial for any organization operating in Saudi Arabia. Compliance not only minimizes legal risks but also enhances credibility with clients and partners.

Compliance Obligations for Organizations under PDPL

Organizations must implement structured and ongoing measures to effectively comply with Saudi Arabia’s Personal Data Protection Law (PDPL). Compliance is not just about adhering to regulations; it also demonstrates a commitment to protecting personal data, which fosters trust and credibility. Below are the key compliance obligations that organizations must fulfill.

Develop a Data Protection Policy

Creating a comprehensive data protection policy is essential for PDPL compliance. This policy should clearly outline data handling practices, including how personal data is collected, stored, processed, and shared. Additionally, it should define roles and responsibilities, such as those of data controllers, processors, and Data Protection Officers (DPOs). Incorporating privacy principles, such as transparency, data minimization, and purpose limitation, ensures that the organization aligns with PDPL standards.

Appointing a Data Protection Officer (DPO)

Appointing a DPO is crucial for organizations processing significant volumes of sensitive data. The DPO monitors compliance, conducts staff training, and liaises with regulatory authorities, such as the Saudi Data & AI Authority (SDAIA). A DPO also handles data requests, including access, correction, and deletion requests from data subjects. Learn more about Sahl’s approach to managing DPO responsibilities on our Compliance Solutions page.

Conducting Data Protection Impact Assessments (DPIAs)

DPIAs are vital for identifying and mitigating risks associated with data processing activities. They help organizations analyze processing practices, assess potential security risks, and develop strategies to address them. Regular documentation of DPIA findings ensures transparency and accountability. Visit our DPIA Best Practices Guide for more insights on conducting practical assessments.

Implementing Data Security Measures

Data security is a core component of PDPL compliance. Organizations must protect personal data through encryption, secure storage, and controlled access. Implementing incident response plans is essential for handling potential breaches effectively. Sahl’s Data Security Toolkit offers practical solutions for enhancing your data protection infrastructure.

Establishing Data Breach Protocols

Organizations must promptly notify the SDAIA within 72 hours when a data breach occurs and inform affected individuals. Proper documentation of the incident and mitigation steps is critical. Establishing an incident response plan helps ensure that breaches are managed efficiently, minimizing impact and demonstrating accountability.

Managing Data Subject Requests

Organizations must have a streamlined process for addressing data subject requests, including requests for access, corrections, deletions, and data portability. Maintaining accurate records of how these requests are handled is essential for demonstrating compliance.

Developing a Data Retention Policy

A well-defined data retention policy outlines how long personal data is stored and specifies secure disposal methods. Organizations should regularly review their retention practices to comply with PDPL requirements. Secure deletion or anonymization of data that is no longer needed reduces the risk of data breaches.

Cross-Border Data Transfer Compliance

Transferring data outside Saudi Arabia requires explicit consent and careful assessment of the recipient country’s data protection measures. Drafting comprehensive data processing agreements can help ensure that cross-border transfers comply with Saudi regulations. Learn how Sahl facilitates secure data transfers in our Cross-Border Compliance Guide.

Regular Compliance Audits

Conducting regular compliance audits helps organizations maintain PDPL adherence. These audits should include reviewing data protection policies, assessing training effectiveness, and ensuring data handling practices align with regulatory updates. Sahl’s Compliance Monitoring Tool can streamline your audit process.

Employee Training and Awareness

Training employees on data protection principles is crucial for maintaining compliance. Regular workshops and awareness programs help staff understand their responsibilities under PDPL. Documenting training sessions and evaluating their effectiveness helps organizations maintain an ongoing commitment to data privacy.

By embedding these practices into everyday operations, organizations meet PDPL requirements and establish a robust data protection framework that enhances trust and accountability.

Penalties and Consequences of Non-Compliance with PDPL

Failing to comply with Saudi Arabia’s Personal Data Protection Law (PDPL) can result in severe financial and reputational penalties. Understanding the potential consequences helps organizations prioritize compliance and mitigate risks. Below is an overview of the penalties and the steps to minimize exposure.

Financial Penalties

The Saudi Data & Artificial Intelligence Authority (SDAIA) enforces PDPL. Non-compliance can lead to significant financial consequences. Organizations found in violation may face hefty monetary fines, reaching up to SAR 5 million (approximately $1.3 million) for severe violations. In some cases, ongoing daily fines may apply if non-compliance continues unaddressed. The severity and nature of the violation often dictate the scale of these financial penalties.

Mitigating Financial Risks

Organizations should proactively conduct compliance audits to reduce the risk of financial penalties. Regular assessments help identify any gaps that need addressing before they escalate. Maintaining thorough documentation is equally important, as it demonstrates due diligence in protecting data. Staff training is another critical factor; employees should be well-versed in data protection practices to minimize risks.

Operational and Business Disruptions

Non-compliance may result in more than just financial setbacks. In severe cases, authorities may suspend business operations or restrict data processing activities until compliance is verified. Repeated violations can also impact licensing, potentially leading to a loss of operational permissions.

Integrating compliance practices within daily operations is essential to managing these risks. Implementing comprehensive compliance systems, such as Sahl’s automated platform, can help track data handling practices continuously. Regular gap assessments and compliance integration help minimize the chances of business interruptions.

Reputational Damage

Beyond fines and operational impacts, non-compliance can significantly harm an organization’s reputation. Data breaches and compliance failures often lead to losing customer trust, which can drive clients toward competitors. Media coverage of non-compliance incidents can also damage the organization’s public image, while partners and investors may question the company’s commitment to data protection.

Maintaining Reputation Through Compliance

Transparency is key to safeguarding reputation. Organizations should communicate openly about their data protection practices and respond promptly in the event of a breach. Demonstrating proactive compliance through certifications and public statements can also reinforce customer and partner confidence.

Legal Consequences

Non-compliance may result in legal challenges in addition to financial and reputational risks. Affected individuals or entities may file lawsuits to claim damages, and ongoing regulatory scrutiny may increase the likelihood of mandatory corrective actions. Organizations should regularly consult legal advisors to minimize these risks to ensure that their data protection practices align with PDPL requirements.

Learning from Real-world Cases

Past compliance failures highlight the risks involved. For example, a healthcare provider in Riyadh faced penalties after failing to encrypt patient data, while an e-commerce company was fined for not updating data processing policies. Another case involved a multinational tech firm penalized for transferring Saudi citizens’ data abroad without adequate safeguards. These cases underscore the importance of maintaining rigorous data protection practices.

How Sahl Supports Compliance

Sahl’s compliance platform offers practical solutions to mitigate the risks associated with PDPL violations. With continuous monitoring, automated alerts for compliance gaps, and centralized documentation, Sahl helps organizations maintain adherence to data protection regulations. The platform’s risk management tools also support identifying and mitigating vulnerabilities, helping organizations avoid costly penalties.

By adopting comprehensive compliance strategies and leveraging automated solutions, businesses can reduce the likelihood of fines, protect their reputation, and maintain operational continuity.

Best Practices for PDPL Compliance

Achieving compliance with Saudi Arabia’s Personal Data Protection Law (PDPL) requires a structured approach tailored to your organization’s unique requirements. Ensuring your business aligns with PDPL standards while minimizing risks involves a proactive and continuous effort.

Conducting a Comprehensive Data Audit

Understanding how your organization collects, stores, and processes personal data is the first step towards compliance. Start by mapping all data inflows, including customer information, employee records, and vendor data. Categorize personal data based on its sensitivity and purpose. Keep a detailed record of all data processing activities, noting how and why data is collected and stored.

To streamline this process, consider using data mapping software that visualizes data flow across your systems. Compliance management platforms like Sahl’s compliance tools can also help maintain a live data inventory, ensuring all data handling practices are well-documented.

Implementing Data Governance Policies

Data governance is essential for maintaining consistent and compliant data handling practices. Develop clear data protection policies that outline how personal data will be managed, stored, and shared. Incorporate key privacy principles like transparency, data minimization, and purpose limitation. Clearly define the roles and responsibilities of data controllers, processors, and Data Protection Officers (DPOs).

Strengthening Data Security Protocols

Safeguarding personal data requires both technical and organizational measures. Use encryption to protect data during transmission and storage. Establish an incident response plan to address potential data breaches promptly. Conduct regular security audits to identify vulnerabilities and ensure your security measures are current. Security Information and Event Management (SIEM) systems and encryption tools can help you maintain data integrity and minimize risks.

Enhancing Transparency and Consent Management

Building trust with data subjects involves clear communication and robust consent practices. Simplifying your consent forms with non-technical language makes it easy for users to understand and agree to data processing terms. Regularly update privacy notices to reflect changes in data usage. Allow users to easily manage their consent preferences through automated consent management platforms.

Training and Educating Employees

A well-informed team is your first line of defense against data breaches. Educate employees on PDPL requirements and best practices for data handling. Focus on areas prone to human error, such as phishing awareness and secure data practices. Role-specific training can help IT, HR, and customer service align with compliance requirements.

Preparing for Data Breach Response

Even with stringent precautions, data breaches can still occur. Establishing a clear response strategy ensures quick action to minimize damage. Assign specific roles for incident management and create clear reporting protocols to notify authorities promptly. An incident management system helps track breach reports and efficiently implement recovery strategies.

Ongoing Compliance Monitoring

PDPL compliance is not a one-time effort; it requires regular monitoring and adaptation. Conduct internal audits to evaluate compliance practices, update your risk assessments regularly, and automate compliance tracking where possible. You can continuously monitor policy adherence by leveraging compliance automation platforms and quickly address potential issues.

Leveraging Sahl’s Compliance Solutions

Sahl’s platform simplifies PDPL compliance by centralizing compliance efforts, automating data monitoring, and managing data subject rights. Whether you need to update your data handling policies or track compliance metrics, Sahl’s tools offer the efficiency and precision required to maintain ongoing compliance.

For more data protection and compliance strategies guidance, visit Sahl’s dedicated compliance resources page. You can also explore our guides on related compliance frameworks, such as ISO 27001 and GDPR, to ensure comprehensive data protection practices.

Addressing Cross-Border Data Transfers Under PDPL

Managing cross-border data transfers is one of the most complex aspects of complying with Saudi Arabia’s Personal Data Protection Law (PDPL). As businesses become more global, transferring personal data between jurisdictions is often necessary. However, the PDPL sets strict guidelines to ensure that personal data remains secure, even when processed or stored outside the Kingdom.

The Challenges of Cross-Border Data Transfers

One of the main challenges organizations face is ensuring that data sent abroad continues to receive the same level of protection mandated by PDPL. This challenge is compounded when working with third-party partners or data processors who may not follow equivalent data protection laws. Another risk involves determining who is accountable if a data breach occurs outside Saudi Arabia’s jurisdiction. Additionally, obtaining regulatory approval for transfers can be a complex and time-consuming, especially if the destination country lacks equivalent data protection standards.

Navigating PDPL Requirements for Cross-Border Data Transfers

Organizations must meet at least one of the following conditions to legally transfer data outside Saudi Arabia. The most straightforward way is to transfer data to a country that maintains data protection regulations on par with PDPL. If that is impossible, organizations must obtain explicit consent from the individuals whose data is being transferred. Another method involves drafting contractual guarantees, such as Standard Contractual Clauses (SCCs), to ensure that the data will be treated with equivalent protection standards. In some cases, gaining explicit approval from the Saudi Data and Artificial Intelligence Authority (SDAIA) may also be necessary.

Implementing Effective Data Transfer Strategies

Managing cross-border data transfers requires a strategic approach. Start by conducting thorough risk assessments to evaluate the compliance status of third-party partners. Verifying that external processors follow data protection practices similar to those required by PDPL is crucial. Additionally, staying aware of geopolitical changes that could impact data security regulations is vital for maintaining compliance.

Establishing well-structured data transfer agreements can also mitigate risks. Utilize SCCs to legally bind data handlers to PDPL standards and draft comprehensive Data Processing Agreements (DPAs) that clearly outline the responsibilities of both parties. These agreements should emphasize maintaining data security and compliance, even when the data moves across borders.

Data anonymization is an effective way to minimize risks further. Anonymizing or pseudonymizing personal identifiers before transferring data can significantly reduce exposure. Automated tools that track and monitor data flows in real time are also invaluable, as they help maintain compliance by instantly flagging irregularities or potential violations.

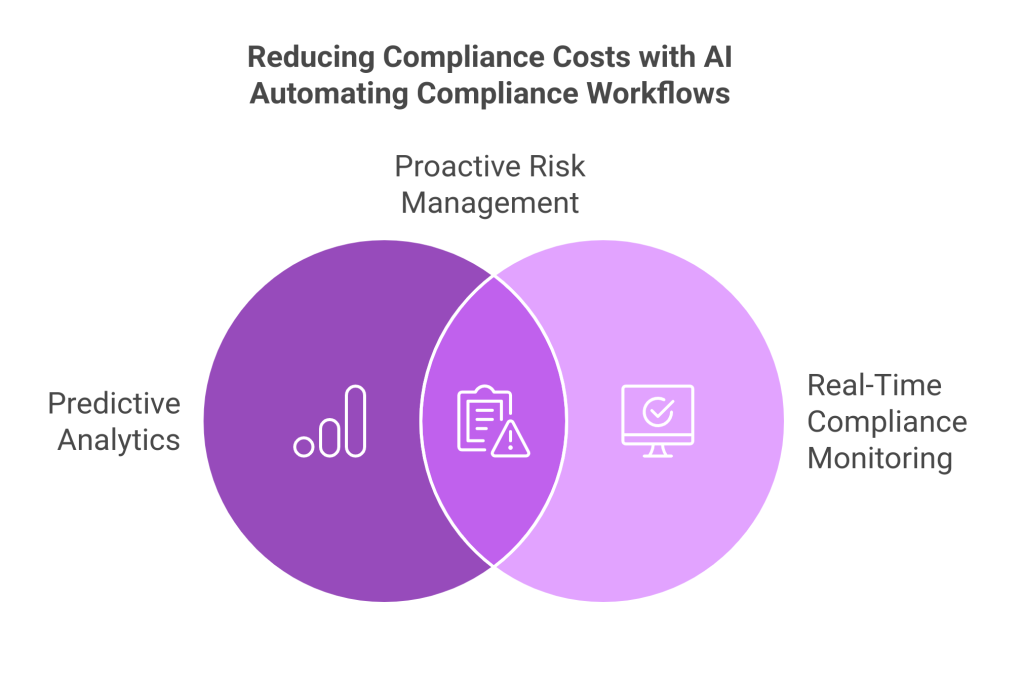

Leveraging AI for Compliance

AI-driven compliance solutions can simplify managing cross-border data transfers. Automated consent tracking can help ensure that necessary permissions are always in place, while real-time compliance monitoring can detect potential issues before they escalate. Risk scoring algorithms can also evaluate the reliability of external data processing partners, offering proactive insights into potential vulnerabilities.

Smart Integration of Sahl’s Platform

Sahl’s compliance automation platform provides an integrated approach to managing cross-border data transfers. It centralizes tracking and reporting, helping organizations maintain oversight and compliance. Features like automated consent tracking and real-time compliance checks enable businesses to stay ahead of regulatory requirements, even as they expand globally.

- NIST Cybersecurity Framework

- ISO 27701 Compliance for Privacy Information Management

- PCI DSS Compliance for Payment Security

Final Thoughts

With the right strategies and tools, cross-border data transfers under PDPL can be effectively managed. By implementing robust data governance practices and leveraging compliance automation, your organization can maintain data integrity while meeting legal obligations. Sahl’s platform is designed to simplify the management of cross-border transfers, ensuring that your business remains compliant even as it operates globally.

Data Subject Rights Under PDPL

The Saudi Personal Data Protection Law (PDPL) grants individuals specific rights regarding how their data is collected, processed, stored, and shared. These rights empower data subjects to control their personal information while ensuring businesses handle data responsibly and transparently.

Understanding Data Subject Rights

One of the core principles of PDPL is to give individuals the power to manage their data. This means organizations must proactively inform individuals about data processing practices, facilitate data access, and allow for updates or deletions as needed.

The Most Important Data Subject Rights Under PDPL

One of the fundamental rights is the Right to Be Informed. Organizations must clearly explain how they collect, use, store, and share personal data. This includes detailing the purpose of data processing and identifying the entities involved. Typically, this information is provided through privacy notices or data protection policies, which should be accessible and easy to understand.

Data subjects also have the Right to Access their data held by an organization. This right goes beyond just knowing what data exists; it also includes obtaining a copy in a readable format. This allows individuals to verify the accuracy of their information and understand how it is being used.

Another critical right is the Right to Rectification. Individuals can request corrections if personal data is found to be inaccurate, incomplete, or outdated. Organizations must promptly address these requests, as maintaining data accuracy is a key compliance obligation.

In certain situations, individuals may exercise the Right to Deletion, commonly known as the “Right to Be Forgotten.” This applies when the data is no longer necessary for the purpose it was collected or when the individual withdraws their consent. However, there are exceptions, particularly when legal obligations require data retention.

The Right to Restrict Processing allows individuals to limit how their data is used, especially when data accuracy is verified. This right ensures that processing does not continue unchecked during such assessments.

Additionally, data subjects have the Right to Data Portability. They can request data in a structured, commonly used, and machine-readable format. Furthermore, they may ask for their data to be transferred to another service provider, facilitating greater control over personal information.

Another protection is the right to object, which allows individuals to oppose data processing when it is based on legitimate interests or public interest. Organizations must carefully evaluate such requests to determine whether there are overriding legitimate grounds to continue processing the data.

Finally, individuals can exercise the Right to Withdraw Consent at any time if the processing is based on consent. Organizations must make the withdrawal process as straightforward as giving consent.

Challenges in Managing Data Subject Rights

Managing these rights effectively can be challenging, especially when dealing with high data requests. Organizations may be overwhelmed with access or deletion requests after a data breach or a major public awareness campaign. Additionally, maintaining accurate records to fulfill these requests can be complex, especially when data is spread across various systems.

Another issue arises with data portability. Transferring data between systems while maintaining integrity and security requires meticulous planning and robust infrastructure. Furthermore, the Right to Deletion sometimes conflicts with legal or regulatory requirements that mandate data retention. Balancing these aspects while ensuring compliance is crucial for organizations.

Best Practices for Managing Data Subject Rights

To effectively manage these rights, organizations should start by developing clear, structured policies outlining handling data subject requests. Automating the process as much as possible can help streamline workflows and reduce the risk of human error. For example, automated compliance tools can help track data access, update, and deletion requests in real time.

Employee training is also essential. Staff should understand the importance of data subject rights and how to process requests by PDPL. Regular training sessions can help maintain a high level of compliance awareness throughout the organization.

Another fundamental practice is maintaining data accuracy. Regularly updating stored data minimizes the need for correction requests and helps uphold data quality. Additionally, leveraging AI-driven data management tools can make tracking data collection and processing more efficient.

How Sahl Supports Data Subject Rights Management

Sahl’s compliance platform offers practical solutions for efficiently managing data subject requests. With automated tracking and real-time access features, organizations can maintain a comprehensive log of all requests and responses. The platform’s consent management system makes it easy to update or withdraw consent when necessary, keeping businesses aligned with PDPL standards.

Internal Links from Sahl Website:

- GDPR Compliance with Sahl

- ISO 27001 Compliance for Information Security

- SOC 2 Compliance for Data Integrity

Final Thoughts

Managing data subject rights under PDPL is not just about regulatory compliance; it also reflects an organization’s commitment to data privacy and customer trust. By proactively implementing best practices and leveraging automated solutions like Sahl’s compliance platform, businesses can efficiently address data subject requests and maintain strong data governance.

Implementing a PDPL Compliance Strategy

Compliance with Saudi Arabia’s Personal Data Protection Law (PDPL) requires a strategic approach that aligns with the law’s key requirements while minimizing disruption to ongoing operations. Implementing PDPL compliance can be challenging, but organizations can establish a robust data protection system that meets regulatory expectations with the right framework.

Start with a Comprehensive Data Audit

The first step in building a compliance strategy is understanding your data landscape. Conducting a thorough data audit helps identify all personal data collected, processed, stored, or shared within your organization. This process involves mapping data flows to see how information moves between systems and third parties and classifying data based on sensitivity, origin, and purpose. Documenting each data processing activity, including the legal basis for each, is crucial for ensuring compliance and facilitating ongoing monitoring.

For more insights on data mapping and best practices, visit Sahl’s Compliance Hub.

Develop a Clear and Comprehensive Compliance Policy

A well-defined compliance policy is the foundation for your organization’s data protection efforts. Start by drafting a policy that articulates your commitment to safeguarding personal data. Outline the roles and responsibilities of data protection officers (DPOs) and other key stakeholders in maintaining compliance. Include practical procedures for handling data subject requests, managing breaches, and facilitating cross-border transfers. Additionally, establish clear guidelines for data retention and secure disposal to ensure that personal data is not kept longer than necessary.

Having a structured policy guides daily operations and demonstrates to regulators that your organization takes data protection seriously.

Educate Your Team on Data Protection Protocols

An effective compliance strategy extends beyond policy creation; it also involves empowering your employees with the knowledge they need to handle data responsibly. Training programs should cover the fundamentals of PDPL, emphasizing why compliance matters and how each team member contributes to protecting personal data. Practical training should include steps for data protection during routine tasks, incident response protocols, and guidance tailored to specific roles within the organization, especially for departments that handle sensitive data.

You can find more about compliance training on Sahl’s Training Resource Page.

Implement Technical and Organizational Safeguards

Compliance with PDPL requires technical and organizational measures to secure personal data effectively. Begin by implementing data encryption and secure storage solutions to protect information from unauthorized access. Multi-factor authentication (MFA) and role-based access control (RBAC) are essential for limiting data access to authorized personnel. Automating the management of data subject access requests (DSARs) can also streamline compliance while minimizing errors.

Maintaining continuous monitoring for suspicious activity is critical for identifying potential security breaches early. Automating these processes through compliance platforms enhances data security and reduces manual workload.

For technical compliance solutions, visit Sahl’s Product Page.

Prepare for Potential Data Breaches

Despite best efforts, data breaches can still occur, making a well-prepared response plan essential. Develop a structured incident response plan that outlines how to detect, report, and investigate data breaches efficiently. Assign roles and responsibilities within your incident response team to ensure quick action when a breach is detected. Having notification templates ready can expedite communication with data subjects and regulatory authorities, minimizing the potential impact of the incident.

After each incident, conduct a thorough review to identify root causes and implement improvements that reduce the likelihood of future breaches.

Maintain Continuous Monitoring and Regular Updates

PDPL compliance is not a one-time project but an ongoing commitment. Regularly review and update your compliance measures to align with regulatory changes and new data protection challenges. Schedule periodic internal audits to assess compliance status and engage third-party experts to ensure thorough evaluations. Keeping your compliance framework up-to-date helps maintain both legal and operational integrity.

Stay informed with the latest developments and best practices by visiting Sahl’s Blog.

How Sahl Can Help

Sahl’s compliance platform provides comprehensive tools for efficiently managing PDPL requirements. By centralizing policy management, automating compliance monitoring, and facilitating real-time updates, Sahl helps businesses maintain data integrity and align with legal standards. From data mapping to ongoing compliance tracking, Sahl’s solutions streamline the complex aspects of data protection, allowing your organization to focus on core operations without compromising privacy.

Integrating PDPL Compliance with Existing Frameworks

For organizations already adhering to global data protection regulations like GDPR or ISO 27001, integrating compliance with Saudi Arabia’s Personal Data Protection Law (PDPL) can be streamlined. By leveraging existing compliance structures, businesses can reduce redundancy while maintaining consistent data governance practices.

Identifying Overlapping Compliance Requirements

One of the first steps in integrating PDPL compliance is identifying where its requirements overlap with existing frameworks. Organizations that already follow international standards, such as GDPR or ISO 27001, may find common ground in several areas. For instance, both PDPL and GDPR emphasize protecting data subject rights and ensuring that data processing is lawful. Similarly, ISO 27001 and PDPL share a focus on data security and risk management, while cross-border data transfer regulations under PDPL may resemble GDPR’s requirements.

Aligning these compliance measures reduces duplication of efforts and ensures that the organization remains compliant with multiple frameworks simultaneously. To learn more about aligning GDPR and PDPL strategies, visit Sahl’s Compliance Blog.

Centralizing Compliance Management

Managing compliance efficiently often means centralizing efforts under a unified governance framework. Instead of treating PDPL as a separate initiative, integrate it into your existing compliance management system (CMS). A single CMS that tracks all regulatory requirements simplifies monitoring and reporting. Additionally, creating standardized templates for data protection impact assessments (DPIAs) that cater to multiple frameworks ensures consistency. Training compliance officers to understand the nuances of PDPL and international standards will further support this unified approach.

By centralizing compliance management, organizations can consistently address all relevant regulations, minimizing the risk of gaps or conflicts. Discover more about integrated compliance strategies on Sahl’s Compliance Hub.

Harmonizing Data Protection Policies

Instead of maintaining separate policies for each regulation, develop comprehensive, harmonized data protection policies that address shared requirements. For example, a unified data retention policy can accommodate PDPL and GDPR requirements, reducing the complexity of managing multiple standards. Additionally, incident response procedures should be designed to meet the requirements of various regulations, allowing for a consistent and efficient approach during data security incidents.

Creating a standard protocol for handling data subject access requests (DSARs) is also essential. This ensures compliance with PDPL and aligns with international standards, simplifying data management. For more insights on creating integrated compliance policies, check out Sahl’s Compliance Hub.

Implementing Cross-Compliance Monitoring

Ongoing monitoring is critical to maintaining compliance with multiple data protection frameworks. Automated monitoring tools can detect discrepancies in data handling practices and flag areas that may affect PDPL and other regulations. Implementing real-time risk assessment tools helps maintain continuous compliance, while automated reporting simplifies tracking across different frameworks. Regular internal audits further verify that compliance measures are effectively integrated, helping identify gaps or areas for improvement.

By adopting automated monitoring practices, organizations can remain proactive in maintaining compliance and reduce the risk of unexpected violations.

Maintaining Consistent Documentation

Consistency in documentation is vital when managing compliance with multiple standards. Maintaining accessible and up-to-date records, whether they pertain to PDPL, GDPR, or other frameworks, helps organizations demonstrate accountability. A centralized document management system can categorize records based on regulatory relevance, maintain version control, and offer clear labeling for cross-compliance documentation. This ensures that any audit or review process is streamlined and all necessary documentation is readily available.

For practical tips on maintaining compliance records, explore Sahl’s Documentation Resource.

How Sahl Can Help

Sahl’s compliance automation platform simplifies the integration of PDPL with other global frameworks. By providing centralized management, automated monitoring, and harmonized policy templates, Sahl supports businesses in maintaining comprehensive and consistent compliance. Whether your organization navigates GDPR, ISO 27001, or PDPL, Sahl offers tailored solutions to meet your data protection needs.

Future of Data Privacy in Saudi Arabia: What to Expect

As global data privacy regulations evolve, Saudi Arabia’s Personal Data Protection Law (PDPL) is also expected to undergo updates and refinements. Organizations aiming to stay compliant must adopt proactive strategies, maintain industry awareness, and build flexible compliance frameworks that can adapt to these changes.

Anticipated Updates to PDPL

With increasing global attention on data protection, Saudi Arabia will likely refine the PDPL to better align with international standards such as GDPR and ISO 27701. As data-driven technologies like artificial intelligence and machine learning become more prevalent, new regulations may address their unique challenges. Additionally, the rules governing cross-border data transfers may be updated to accommodate the realities of global business practices better.

Another expected change could involve strengthening penalties for non-compliance to ensure a more robust regulatory framework. Staying updated on these developments is crucial for businesses operating in or with the Kingdom. For the latest insights on regulatory changes, visit Sahl’s Regulatory Insights.

Growing Role of Technology in Compliance

As digital transformation accelerates, the role of technology in managing PDPL compliance is becoming increasingly important. Organizations are beginning to leverage AI-powered compliance tools to automate monitoring, reporting, and data protection measures. These advanced tools can help detect potential breaches in real-time, reducing non-compliance risk and providing reassurance about the state of your compliance efforts.

Blockchain technology is also emerging as a valuable tool for ensuring data integrity, enhancing transparency, and providing traceable records of data handling processes. Furthermore, privacy-enhancing technologies (PETs) like data encryption and anonymization are being adopted to minimize risks associated with data breaches.

To learn more about leveraging technology for compliance, explore Sahl’s Compliance Blog.

Increased Scrutiny from Regulators

As data privacy awareness grows, regulatory authorities will likely intensify their scrutiny. Businesses should be prepared for more frequent audits and compliance checks from Saudi data protection authorities. Additionally, multinational organizations may face heightened collaboration between Saudi regulators and international bodies to ensure consistent data protection practices.

In particular, cloud-based solutions and cross-border data practices may receive closer examination, especially given the increased focus on data sovereignty. Companies must ensure that their data processing activities adhere to PDPL requirements, regardless of where the data is stored or processed.

For tips on preparing for regulatory scrutiny, visit Sahl’s Compliance Blog.

Best Practices for Ongoing Compliance

Businesses should adopt a forward-thinking approach to maintaining continuous compliance with evolving regulations. Implementing real-time compliance monitoring can help track adherence and identify potential issues before they escalate. Additionally, investing in ongoing training ensures that employees remain aware of the latest data protection practices and regulatory updates.

Scenario planning can also be valuable. Organizations can develop flexible policies that accommodate future updates by preparing for potential changes in data privacy laws. Partnering with compliance experts can ensure that new regulations are interpreted accurately and integrated efficiently into existing practices.

Discover more strategies for maintaining compliance on Sahl’s Compliance Strategies.

Building a Culture of Data Privacy

Fostering a privacy-centric culture goes beyond meeting compliance requirements. It involves embedding data protection principles into everyday business processes and promoting employee awareness. Transparent communication with customers about how their data is collected, stored, and used is essential for building trust and maintaining a positive brand reputation. By prioritizing a culture of data privacy, your organization can empower employees to take ownership of compliance responsibilities and contribute to a positive brand image.

Organizations that prioritize data privacy as a core value will mitigate compliance risks and enhance their credibility with customers and partners. Creating a culture that values data protection encourages employees to take ownership of compliance responsibilities, reducing the risk of violations.

For more insights on building a data privacy culture, visit Sahl’s Compliance Strategies.

How Sahl Can Help

Sahl’s compliance platform offers a comprehensive approach to managing PDPL compliance and staying prepared for future updates. From real-time monitoring to automated reporting and secure data management, Sahl’s solutions help organizations maintain consistent compliance while adapting to evolving regulations.

FAQs on PDPL Compliance

1. What is the Saudi Arabia Personal Data Protection Law (PDPL)?

The Saudi Arabia Personal Data Protection Law (PDPL) is a legal framework established to protect the Kingdom’s personal data and privacy rights. It mandates that organizations handling personal data follow strict data collection, storage, processing, and sharing guidelines to ensure privacy and security.

2. Who must comply with PDPL?

Any organization or entity, whether public or private, that collects, processes, or stores the personal data of individuals within Saudi Arabia must comply with PDPL. This includes local businesses, multinational corporations operating in Saudi Arabia, and third-party service providers managing Saudi citizens’ data.

3. What are the penalties for non-compliance with PDPL?

Penalties for non-compliance with PDPL can include hefty fines, legal actions, and possible restrictions on business operations. Specific penalties depend on the severity and nature of the violation, ranging from administrative fines to criminal liability for intentional data misuse.

4. What types of data are protected under PDPL?

PDPL protects all personal data that can directly or indirectly identify an individual, including names, ID numbers, contact information, health records, financial details, etc. It also covers data collected digitally or physically, emphasizing protection across various data handling practices.

5. How does PDPL impact cross-border data transfers?

PDPL imposes strict regulations on transferring personal data outside Saudi Arabia. Organizations must ensure that any cross-border data transfer complies with specific requirements, including obtaining explicit consent from data subjects and ensuring the recipient country provides adequate data protection measures.

6. How can organizations achieve PDPL compliance?

Organizations can achieve PDPL compliance by implementing robust data protection policies, conducting regular data audits, training employees on data privacy practices, and using tools like Sahl’s compliance automation platform to streamline documentation and monitoring processes.

7. How does PDPL differ from GDPR?

While PDPL and GDPR aim to protect personal data, PDPL is specifically tailored to the Kingdom of Saudi Arabia. GDPR has a broader scope, applying to EU citizens’ data globally. PDPL includes region-specific requirements concerning cross-border data transfers and subject rights.

8. How can Sahl help with PDPL compliance?

Sahl’s compliance automation platform provides comprehensive tools for managing PDPL requirements, including data mapping, risk assessments, documentation automation, and continuous monitoring. The platform helps organizations maintain audit readiness and streamline compliance workflows.

Conclusion: Navigating PDPL Compliance with Confidence

Saudi Arabia’s Personal Data Protection Law (PDPL) represents a significant step toward enhancing data privacy and security in the Kingdom. As businesses adapt to the evolving regulatory landscape, it becomes clear that compliance is not just a legal obligation but a strategic imperative.

Implementing PDPL compliance requires a thorough understanding of the law’s provisions, a proactive approach to data management, and a commitment to safeguarding personal data. Organizations that prioritize compliance mitigate legal risks and build trust with customers and partners.

Why Choose Sahl for PDPL Compliance

Navigating PDPL can be daunting, especially for organizations that handle vast data or operate across borders. Sahl’s compliance solutions are designed to simplify the process, offering:

- Automated data protection workflows tailored to PDPL requirements.

- Real-time monitoring and reporting for continuous compliance.

- Expert guidance on cross-border data transfer protocols.

- Tools to manage data subject rights efficiently and transparently.

Businesses can stay compliant without the administrative burden by leveraging Sahl’s expertise and cutting-edge technology.

Looking Ahead: Stay Prepared and Proactive

The regulatory environment continuously evolves, and keeping up with changes is crucial. Organizations must regularly review their data protection strategies, update policies, and invest in compliance technology to remain aligned with PDPL requirements.

By adopting a proactive mindset and leveraging comprehensive compliance solutions, businesses can confidently navigate the challenges posed by PDPL while protecting their operations and customers’ data. For more insights on compliance strategies, visit Sahl’s Compliance Hub.

Additional Resources and References:

- Sahl Compliance Platform: Explore how Sahl’s automated compliance solutions can help your organization stay PDPL compliant. Visit Sahl’s Compliance Platform.

- Saudi Data & AI Authority (SDAIA): Official regulatory body overseeing data protection in Saudi Arabia. SDAIA Official Website

- International Association of Privacy Professionals (IAPP): Global resources on data privacy. Visit IAPP

- Data Protection World Forum: Insights and case studies on compliance. Visit DPWF

- Middle East Policy Council: Contextual insights on regional data regulations. Visit MEPC