AI compliance automation for SMEs is no longer a luxury—it’s a necessity. Staying ahead of ever-shifting regulations is a perennial headache for small and medium enterprises. Limited headcount, tight budgets, and fragmented systems often turn compliance into a full-time job that distracts from core business priorities like product development, customer service, and sales. Artificial intelligence offers a new path—transforming compliance from a reactive scramble into a proactive, data-powered discipline by automating evidence collection, mapping controls to multiple frameworks, and surfacing real-time risks.

Why SMEs Struggle Without AI Compliance Automation

Most SMEs lack dedicated compliance teams. Instead, finance managers or IT generalists juggle policy updates, audit preparations, and incident reports alongside their day jobs. When regulatory requirements for frameworks like GDPR, SOC 2, or the Saudi PDPL change, manual processes spreadsheets, shared folders, and one-off reminders break down. The result is missed deadlines, last-minute scrambles, and the risk of costly penalties.

The AI Advantage: From Manual Chores to Intelligent Automation

Rather than fighting spreadsheet sprawl, AI SME compliance solutions centralize evidence and automate repetitive tasks. Imagine a system that:

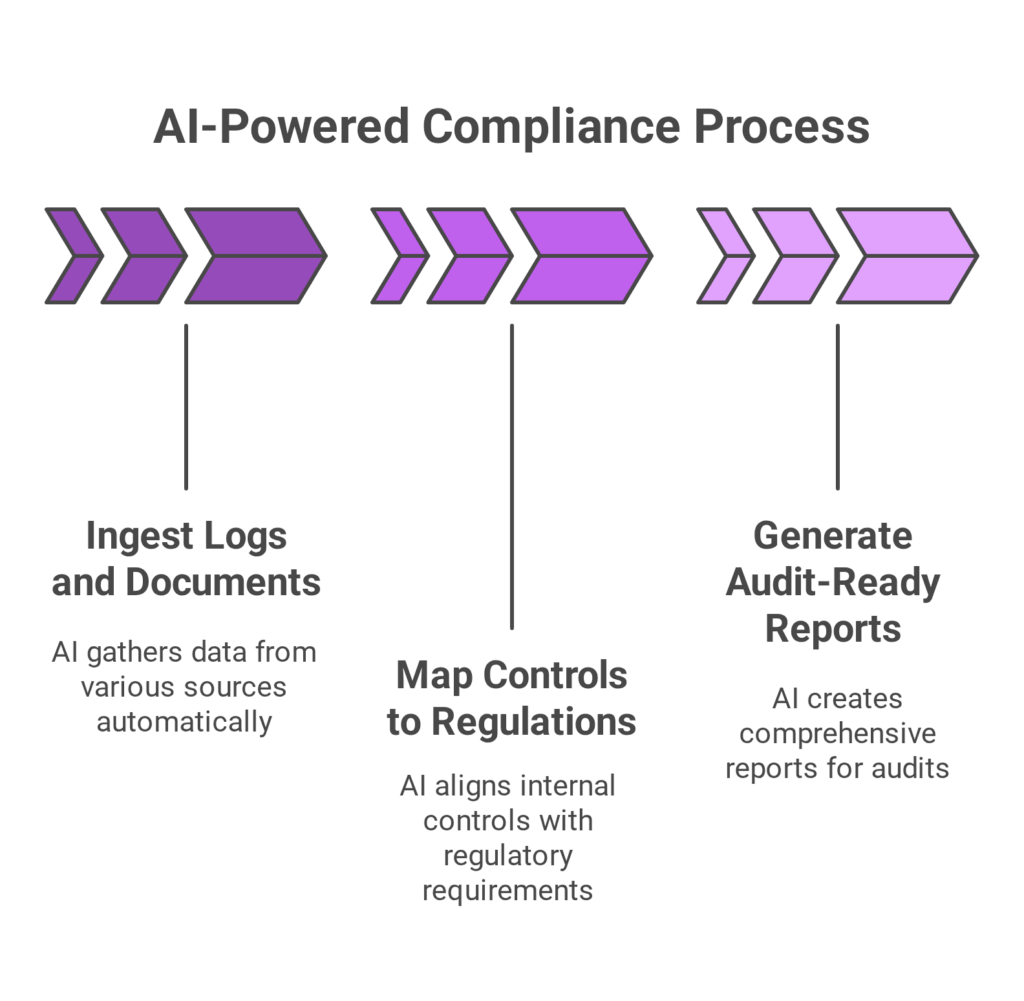

- Ingests logs and documents from every source, including cloud storage, HR systems, and ticketing platforms, without manual uploads.

- Continuously maps your controls to relevant regulations, flagging gaps when a clause is updated.

- Generates audit-ready reports at the click of a button, complete with date-stamped evidence and drill-down links.

By shifting the burden of data gathering and cross-referencing onto machines, these platforms empower your team to make informed policy decisions and mitigate risks.

Key Features of AI-Powered Compliance Tools

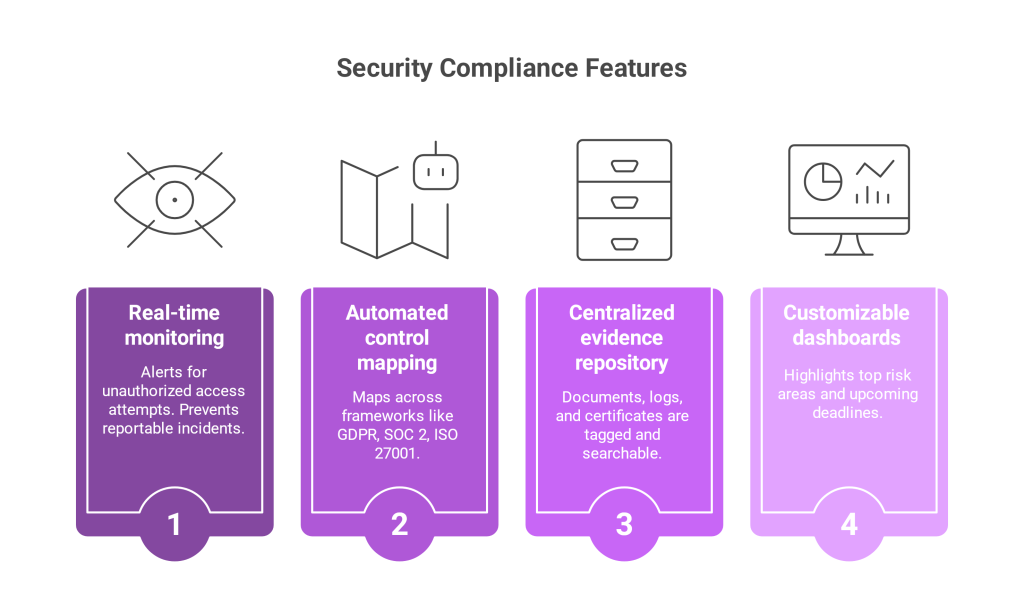

While each vendor differs, most leading solutions share several hallmarks:

- Real-time monitoring that alerts you to anomalies such as unauthorized access attempts before they become reportable incidents.

- Automated control mapping across frameworks: GDPR articles, SOC 2 Trust Services Criteria, ISO 27001 clauses, or PDPL requirements.

- Centralized evidence repository where every document, log entry, and certificate is tagged, searchable, and audit-ready.

- Customizable dashboards that highlight your top risk areas and upcoming deadlines, ensuring nothing slips through the cracks.

For a detailed explanation of how this works in practice, see our guide on Compliance Automation through AI in Saudi Arabia.

How AI Compliance Automation Helps SMEs Cut Costs and Risks

Automating compliance chores yields immediate efficiency gains. SMEs report up to a 70 percent reduction in hours spent on evidence gathering and report generation, making your team more productive. Fewer manual handoffs mean fewer errors and fewer surprises during audits. Organizations minimize the risk of fines and reputational harm by maintaining continuous compliance rather than scrambling for snapshots.

That translates to real dollars saved on consulting fees, late filing penalties, and ad-hoc remediation projects. You not only cut labor costs but also avoid the downstream expenses of non-compliance.

Best Practices to Implement AI Compliance Automation for SMEs

Begin by identifying your highest-impact framework, whether GDPR for your EU customers or the Saudi PDPL for local operations. Next, connect your existing systems via API: cloud storage, IAM tools, HR platforms, and ticketing systems. Allow the AI engine to ingest historical logs, then tune its alerts around your organization’s specific risk thresholds.

Training is equally crucial. Offer short, practical workshops that show your team how to interpret AI-generated findings and act on them rather than trying to master every regulatory nuance upfront. Start small and automate one or two critical controls first, then expand to cover additional frameworks as confidence grows.

A Glimpse at the Future

By 2025, compliance will routinely follow the money, not the calendar. AI platforms will predict which controls are likely to draw regulatory scrutiny next quarter based on enforcement trends and automatically surface them for review. Small teams will finally wield the same predictive risk-scoring capabilities that large enterprises use today, ensuring they allocate scarce resources where they matter most.

Conclusion

For SMEs, embracing automated compliance for startups is less about fancy technology and more about survival. AI-powered platforms turn best-practice workflows into live, continuously monitored processes, freeing teams from endless manual tasks while driving down risk and cost.

If you’re ready to move beyond spreadsheets and alerts that arrive too late, explore how Sahl’s AI compliance platform can transform your regulatory program into a competitive advantage.