AI-driven compliance solutions are transforming how businesses manage regulatory compliance—cutting costs, reducing errors, and improving accuracy across industries. The complexity of compliance mandates and the cost of adherence create major challenges for operational efficiency. Manual audits, static reports, and fragmented risk assessments often cause inefficiencies, errors, and higher costs.

Integrating artificial intelligence (AI) into compliance management redefines how businesses approach regulatory adherence. AI-driven solutions facilitate automated regulatory compliance, reducing operational costs while improving accuracy through predictive analytics, real time monitoring, and intelligent decision making. This article explores the impact of AI on compliance, focusing on its role in cost reduction and accuracy enhancement.

How AI-Driven Compliance Solutions Reduce Costs

Automating Compliance Workflows

Manual compliance processes require substantial labor resources, increasing costs, and inefficiencies. AI-driven automation mitigates these challenges by streamlining data processing, risk assessment, and compliance reporting. Organizations leveraging AI-powered compliance tools have reported up to 30% cost savings due to reduced manual intervention and lower error rates.

For instance, financial institutions integrating AI-driven risk management systems have seen significant reductions in non compliance penalties by automating Know Your Customer (KYC) and Anti Money Laundering (AML) procedures. AI-driven automation facilitates real-time data validation, ensuring regulatory requirements are met efficiently while minimizing administrative overhead.

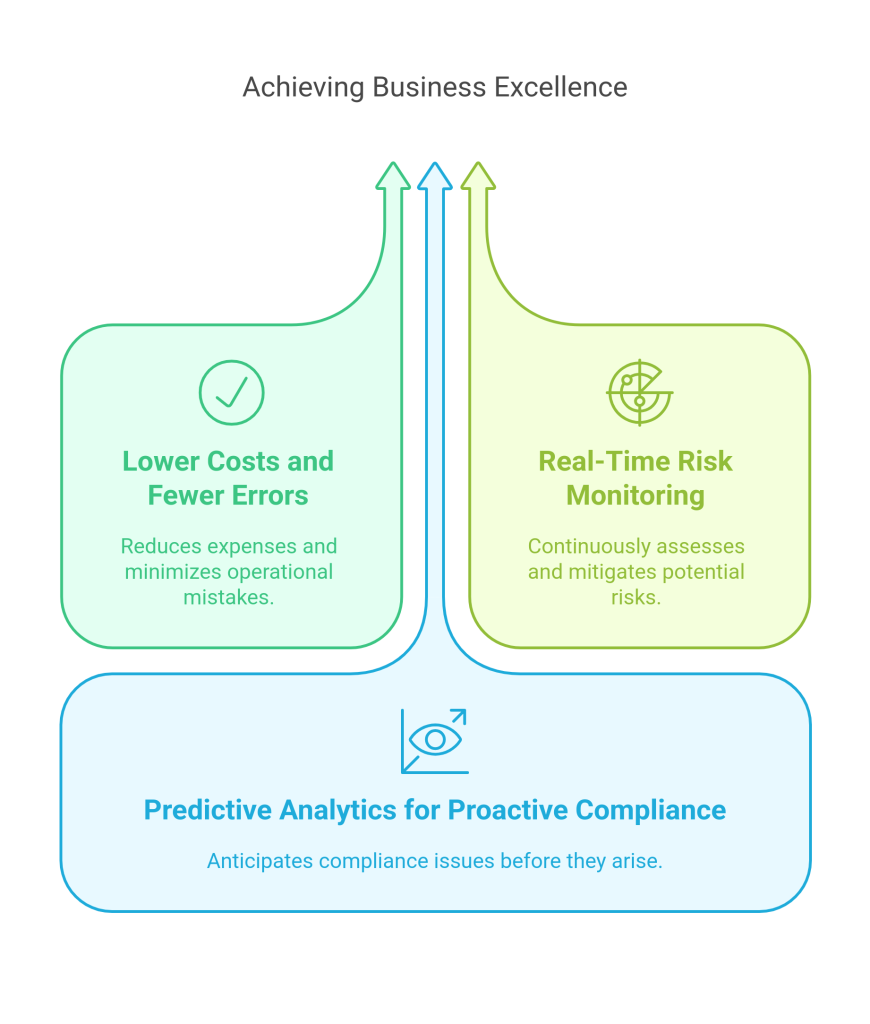

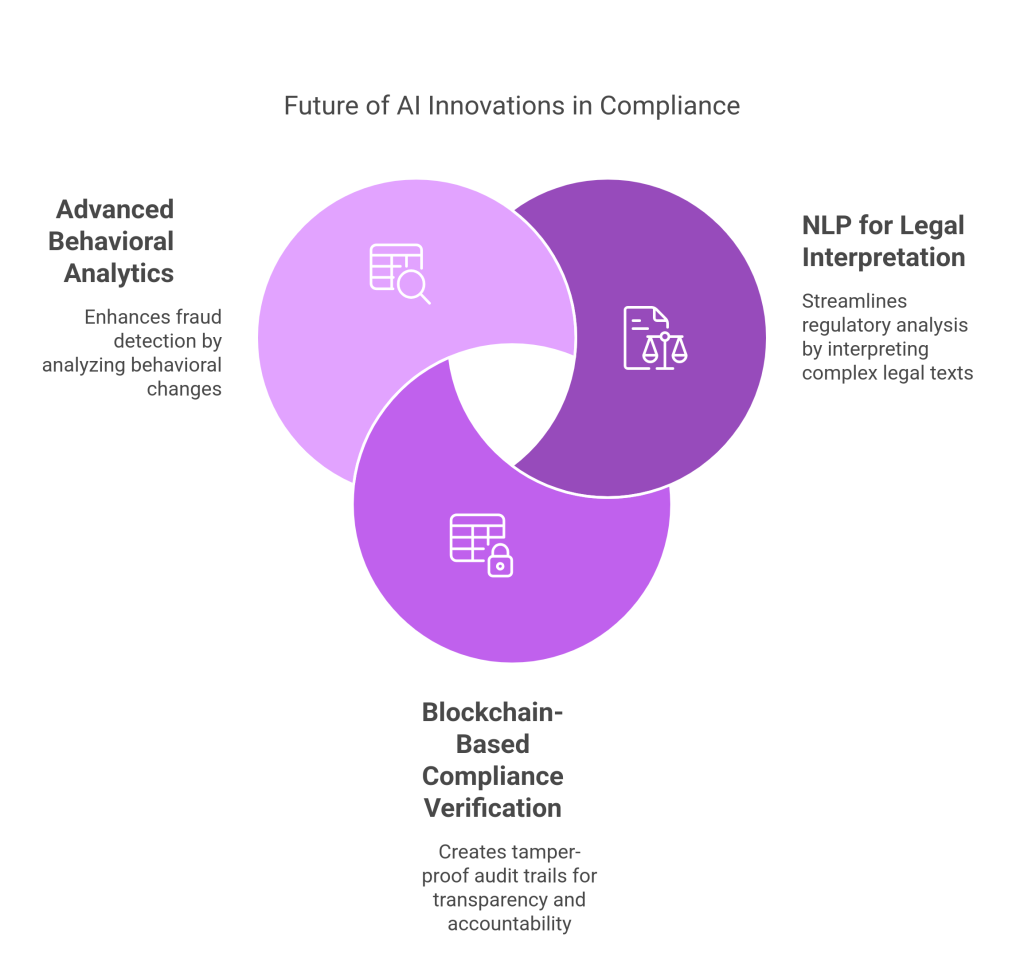

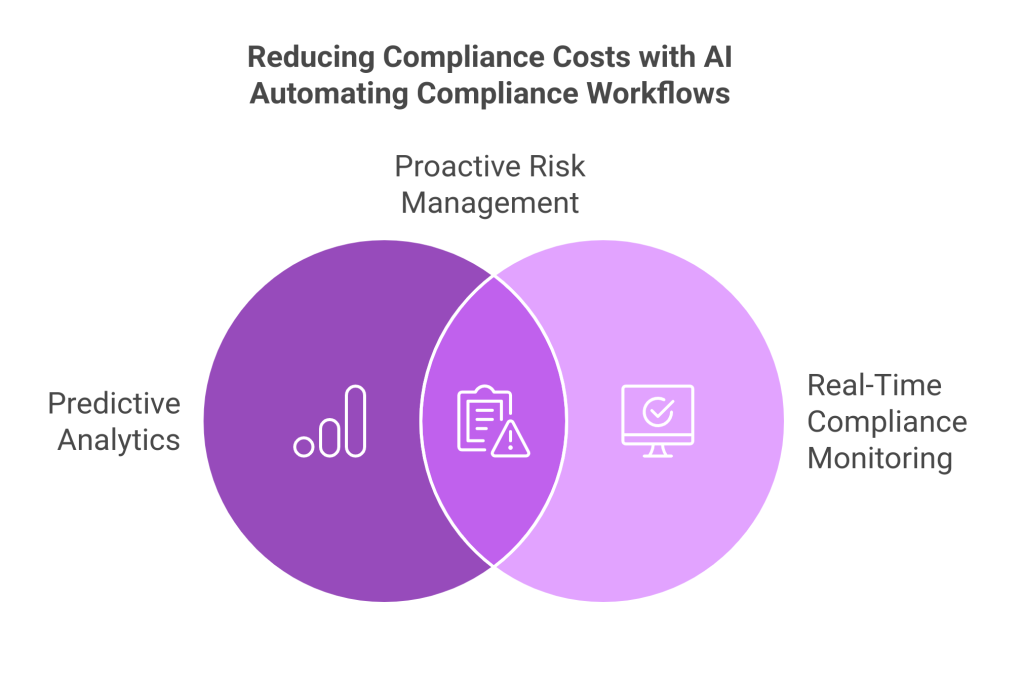

Enhancing Risk Assessment through Predictive Analytics

AI enables predictive analytics in compliance management, allowing organizations to identify and mitigate risks proactively. By analyzing historical data and regulatory trends, AI can forecast potential compliance breaches before they escalate into financial liabilities. A study found that organizations using AI-powered risk tools saw a 35% drop in compliance costs. Proactive risk management helped minimize penalties and disruptions. For example, AI-driven fraud detection in audits improved efficiency by 45%, helping teams prevent violations before they happen. AI identifies patterns and anomalies in financial transactions through machine learning algorithms, flagging potential regulatory breaches in real time.

Real Time Compliance Monitoring

Traditional compliance audits often occur periodically, leaving organizations vulnerable to undetected regulatory infractions. AI-powered real time monitoring systems continuously assess compliance data, detecting deviations as they happen. This ensures that corrective measures are implemented promptly, reducing the financial impact of non-compliance.

A case study in the pharmaceutical industry revealed that AI-driven audit systems improved regulatory adherence by 70%, reducing penalties associated with compliance failures. By integrating AI-based monitoring tools, organizations ensure continuous oversight, eliminating the need for costly retrospective audits.

Enhancing Accuracy in Compliance Management

Intelligent Compliance Decision-Making

AI-driven intelligent compliance solutions enhance regulatory accuracy by dynamically adapting to evolving compliance standards. Unlike static rule-based systems, AI continuously refines its decision making processes through machine learning, ensuring compliance frameworks remain aligned with the latest regulatory mandates.

For instance, organizations employing AI-driven compliance automation have reported a 60% improvement in adherence to ethical and legal guidelines. AI enhances decision making by processing unstructured compliance data from multiple sources, ensuring comprehensive regulatory coverage and minimizing the risk of human oversight.

Optimizing Audits with AI

The audit process is inherently complex, requiring meticulous data validation and anomaly detection. AI-powered audit optimization systems enhance accuracy by automating data reconciliation, ensuring that compliance reports are free from inconsistencies.

Machine learning algorithms can identify errors in financial reporting with up to 70% greater accuracy than manual audits. AI-enabled compliance tools streamline the audit process by extracting key regulatory insights from vast datasets, allowing compliance teams to focus on strategic oversight rather than manual data verification.

AI-Driven Regulatory Adaptation

Regulatory frameworks are constantly evolving, necessitating frequent updates to compliance protocols. AI systems with natural language processing (NLP) analyze regulatory texts in real time, ensuring businesses comply with the latest legal requirements. Organizations utilizing AI for regulatory adaptation report a 30% reduction in non compliance incidents, as AI-driven insights proactively update internal policies to align with new mandates. For example, financial services firms employing AI for real time regulatory tracking have significantly improved their ability to adapt to over 2,000 regulatory changes per year, mitigating compliance risks before they escalate into legal challenges.

Leveraging AI for Scalable Compliance Management

AI-Powered Compliance Solutions

Businesses seeking scalable compliance solutions can explore AI-driven platforms such as Sahl, which offers advanced automation for regulatory adherence. AI-powered compliance tools facilitate risk mitigation, fraud detection, and audit optimization, ensuring that organizations achieve cost effective and accurate compliance outcomes.

Additionally, organizations can gain deeper insights into AI-driven compliance strategies by referencing How AI is Transforming Compliance Automation, highlighting best practices for AI integration in compliance frameworks.

Conclusion

Integrating AI in compliance management offers substantial cost reductions and enhanced accuracy, enabling organizations to navigate regulatory challenges efficiently. Businesses can proactively mitigate risks, reduce compliance expenses, and improve regulatory adherence by leveraging AI-powered automation, predictive analytics, and intelligent compliance systems.

Organizations that adopt AI-driven compliance can reduce financial risks and lead in regulatory innovation. As rules keep changing, AI will be key to maintaining cost-effective, accurate, and sustainable compliance. By using AI-driven compliance solutions, organizations stay ahead of regulations, ensure accuracy, and drive long-term value.